Need a fast personal loan without dealing with documents? An easy personal loan is a straightforward, hassle-free borrowing option that can be obtained quickly and with minimal documentation. An instant personal loan without documents lets you get the money you need without the usual paperwork hassle. This article covers how these loans work, their benefits, eligibility criteria, and how to apply.

Key Takeaways

- Instant personal loans without documents offer rapid access to funds, often disbursed within hours, catering to urgent financial needs.

- These loans are available with minimal documentation, making the application process fast and convenient.

- Eligibility criteria include a minimum CIBIL score of 685 and maintaining a debt-to-income ratio of 50% or lower, allowing for broader access for borrowers.

- Different types of document-free loans, such as pre-approved, digital lender, and salary-based loans, provide various options for quick financial assistance.

Understanding Instant Personal Loans Without Documents

Instant personal loans without documents are a game-changer in the financial industry. These unsecured loans allow borrowers to access funds without the need for extensive paperwork, making the process incredibly convenient and swift. Advanced digital algorithms enable lenders to swiftly assess your creditworthiness and offer approvals much faster than traditional methods. This means you could potentially have the funds disbursed to your account within a single day, including options for an instant personal loan without collateral free loans and a paperless personal loan. Additionally, instant loans provide a quick solution for those in need of immediate financial assistance.

What makes these loans stand out is their flexibility in borrowing amounts and the convenience they offer. Gone are the days of tedious paperwork and lengthy approval processes. These loans allow you to apply for an instant loan online, get approved, and receive the required loan amount and loan amounts in a short time frame. With an instant personal loan online, you benefit from a hassle-free digital application process, minimal documentation, and rapid approval, making it easy to access funds quickly through websites or mobile apps.

This innovation not only caters to emergency financial needs but also aligns with the fast-paced lifestyle of today’s digital age. An online personal loan offers flexibility and can be used for various purposes without restrictions on end use.

Key Benefits of Document-Free Personal Loans

The key benefits of instant personal loans without documents extend beyond just speed and convenience. One of the most attractive features is the rapid disbursement of funds, which can occur as quickly as 30 minutes to 4 hours after loan approval. This immediate access to cash makes it an ideal solution for emergencies or urgent financial needs, providing instant credit when you need it most. An instant loan can be a valuable option in such situations, especially when you consider the documents instant personal loan option.

Additionally, the absence of cumbersome paperwork eliminates traditional barriers, making the loan application process straightforward and hassle-free. The streamlined process prioritizes the borrower’s needs, offering quick approvals and extensive documentation for a seamless experience.

Overall, the main advantages are quick approval, minimal paperwork, and immediate access to funds, all aimed at ensuring a stress-free borrowing experience.

Eligibility Criteria for Instant Personal Loans

While the application process for instant personal loans is simplified, there are still specific eligibility criteria that borrowers must meet to qualify. Generally, a minimum CIBIL score of 685 is required. This score reflects your creditworthiness and is crucial for loan approval. Additionally, maintaining a debt-to-income ratio of 50% or lower can significantly enhance your chances of approval.

Self-employed individuals can qualify without a salary slips, provided other eligibility criteria are satisfied. However, some lenders may still require basic address proof or recent bank statements to verify eligibility, even for instant personal loans without documents. This inclusivity ensures that a broader range of individuals can access these loans. Existing loans are also taken into account when assessing your debt-to-income ratio, which is a critical factor in the approval process.

Moreover, joint applications are allowed, particularly beneficial if you can apply with a salaried spouse. This can increase the total loan amount available to you, offering more flexibility in managing your financial needs. Personal loans can be tailored to fit your financial situation, ensuring that they meet your specific requirements. A personal loan jointly can enhance your borrowing potential.

Types of Instant Personal Loans Available Online

Understanding the various types of instant personal loans available online can help you choose the best option for your needs. These loans are an unsecured loan, meaning no assets need to be pledged, which eliminates the risk of losing personal property. In contrast, secured loans require collateral such as gold or fixed deposits and may offer lower interest rates or faster approvals.

While there are several types of loans, three of the most common include pre-approved personal loans, digital lender loans, and salary-based personal loans. Let’s explore each type in more detail.

Pre-Approved Personal Loans

Pre-approved personal loans are a convenient option for those who are already customers of a bank or financial institution. These loans are offered through NetBanking and require no additional documents. The primary advantage is the speed at which the loan can be disbursed, often within minutes.

Simply log into your NetBanking bank account to check for a pre-approved offer. If you qualify, you can complete the application without any paperwork. This type of loan is ideal for individuals looking for quick and easy access to funds without the hassle of documentation.

Digital Lender Loans

Digital lender loans are provided by non-traditional financial institutions online. These loans offer a high level of convenience and speed, with approval times often being just a matter of minutes. The application process involves filling out an online form, and depending on your eligibility, you could receive approval almost instantly.

The primary benefits include minimal paperwork, quick approval times, and immediate access to funds. The personal loan eligibility criteria typically include a minimum credit score, age, and income level, making it easier for many to qualify. These loans are ideal for individuals who prioritize speed and efficiency in their financial transactions.

Salary-Based Personal Loans

Salary-based personal loans are designed for individuals with stable income and regular employment. Approval for these loans usually hinges on the applicant’s income level and job stability. These loans typically offer higher amounts based on the borrower’s consistent income, providing more flexibility for larger financial needs.

If you can provide income proof of stable income, these loans may offer a smoother approval process. Whether you need funds for medical bills or other urgent expenses, salary-based loans can be a reliable option for quick financial assistance.

Personal Loan Features and Fees

Personal loans are a popular type of unsecured loan that can be used to cover a wide range of financial expenses, from medical bills and home renovations to weddings and travel. Because personal loans do not require collateral, they offer a flexible and accessible solution for individuals seeking quick financial assistance. However, before applying, it’s important to understand the key features and fees associated with personal loans to ensure you make an informed decision.

Processing Fees

Processing fees are charges that lenders apply to cover the administrative costs of evaluating and sanctioning your personal loan application. These fees can vary significantly between lenders and may be calculated as a flat amount or as a percentage of the total loan amount. For example, some lenders might charge a processing fee of 1-2% of the loan amount, while others may have a fixed fee regardless of the loan size. Always factor in processing fees when comparing personal loan offers, as they directly impact the total cost of borrowing.

Interest Rates

Interest rates are a crucial factor in determining the affordability of personal loans. The rates offered can differ based on your credit history, income level, and the chosen loan tenure. Securing competitive interest rates can make a significant difference in your monthly payments and the overall cost of the loan. It’s wise to compare interest rates from multiple lenders to find the most affordable option that suits your financial situation. Remember, a strong credit history and stable income can help you qualify for lower interest rates on your personal loan.

Other Charges to Consider

Beyond processing fees and interest rates, personal loans may come with additional charges that can affect the total repayment amount. These can include late payment fees, prepayment or foreclosure charges, and loan cancellation fees. It’s essential to carefully review the loan agreement to understand all potential costs before committing. Being aware of these charges helps you avoid surprises and ensures you can manage your personal loan responsibly.

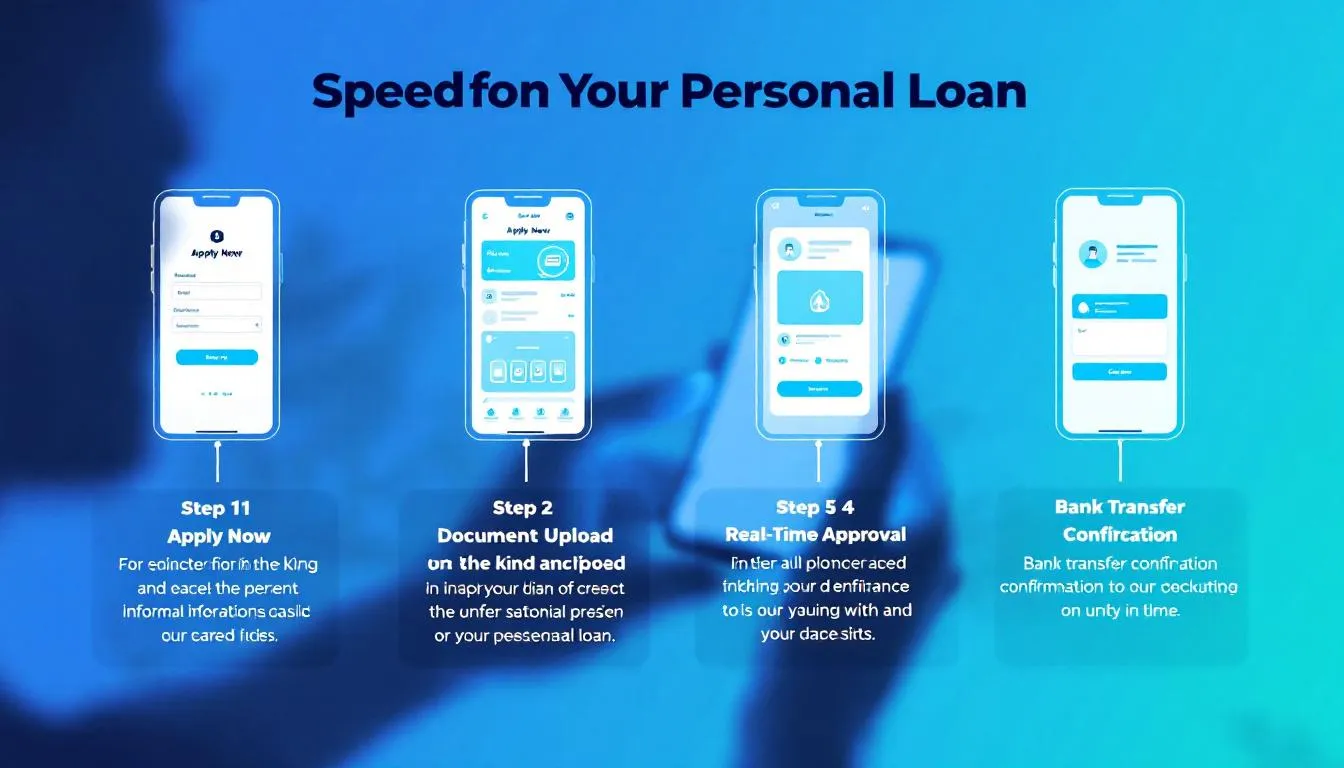

Steps to Apply for a Personal Loan Without Documents

Applying for a documents personal loan without documents is incredibly straightforward. The entire process is designed to be completed online, eliminating the need to visit a bank. Start by filling out the personal loan application form on a trusted online platform. This form can be submitted in just a few clicks, making the process quick and efficient.

After submitting your application, the lender will evaluate your eligibility and process the financing, often within a day. Existing customers may not need to submit any additional documentation, further streamlining the loan approval process. This approach ensures that you can access the funds you need without any unnecessary delays.

Tips to Increase Approval Chances for Document-Free Loans

Boosting your chances of approval for instant personal loans without documents involves several strategic steps. Maintaining a high CIBIL score and a clean credit history is essential. A credit score of 700 or above can significantly improve your chances of securing favorable loan terms.

When applying for a loan, keep the following points in mind:

- Provide accurate, up-to-date income and employment details during the application process.

- Repayment history is a critical factor in the lender’s assessment of your creditworthiness, along with your credit report.

- Avoid submitting multiple loan applications simultaneously, as doing so can harm your credit score.

Debt to Income Ratio: Why It Matters for Your Loan Approval

When you apply for a personal loan online, one of the most important factors lenders consider is your debt-to-income ratio. This ratio measures the percentage of your monthly income that goes toward repaying debts, including credit card bills, existing loan EMIs, and other financial obligations. A lower debt-to-income ratio signals to lenders that you have a strong repayment capacity, which can increase your chances of instant personal loan approval.

To calculate your debt-to-income ratio, simply add up all your monthly debt payments and divide that total by your monthly income. For example, if your total monthly debt payments are ₹20,000 and your monthly income is ₹50,000, your debt-to-income ratio would be 40%. Most lenders prefer a ratio below 50%, as this indicates you can comfortably manage additional loan amounts without straining your finances.

Maintaining a healthy debt-to-income ratio is not only crucial for loan approval but also for your long-term financial stability. A good credit score, combined with a low debt-to-income ratio and a steady income, can help you qualify for instant personal loans with competitive interest rates, affordable interest rates, and flexible repayment options. This is especially important for those seeking a collateral free personal loan or looking for a hassle free loan application process.

If you already have an existing loan, you might consider a personal loan balance transfer to a new lender offering better terms or lower interest rates. This can help reduce your interest burden and simplify your monthly repayments. By managing your debt obligations effectively and understanding the impact of your debt-to-income ratio, you can make informed decisions throughout the loan application process and secure the financial assistance you need for your personal or medical expenses.

Ultimately, being aware of all the features, fees, and eligibility criteria associated with personal loans empowers you to choose the right loan product for your financial needs. By keeping your debt-to-income ratio in check and reviewing all terms in the loan agreement, you can enjoy the benefits of instant personal loans without unnecessary stress or financial strain.

Managing Repayment of Instant Personal Loans

Effective management of loan repayment is crucial to maintaining financial health. Here are some key points to consider:

- Use a personal loan emi calculator to determine your monthly repayment amounts based on the loan and tenure, including options for monthly instalments.

- Set up automatic payments for your personal loan emi to ensure timely repayment.

- Timely repayment helps sustain a positive credit history.

Making extra payments when possible can lower the overall loan duration and total interest paid. If you face repayment challenges, contact your lender for potential flexible repayment options or loan restructuring options to assess your repayment capacity.

Managing repayments efficiently not only maintains a healthy credit score but also relieves financial stress.

Important Considerations Before Applying for a Paperless Loan

Before applying for a paperless loan, several key factors need to be considered. Fixed interest rates play a crucial role in determining the overall cost of your loan and can vary based on factors like credit score and loan amount. The loan tenure also significantly impacts your monthly payments and total interest costs, especially when considering competitive interest rates and the interest rate environment.

Additionally, researching the lender’s credibility is essential. Look into their reputation and customer reviews to ensure you are dealing with a reputable institution. These considerations will help you make a well-informed decision and avoid potential pitfalls.

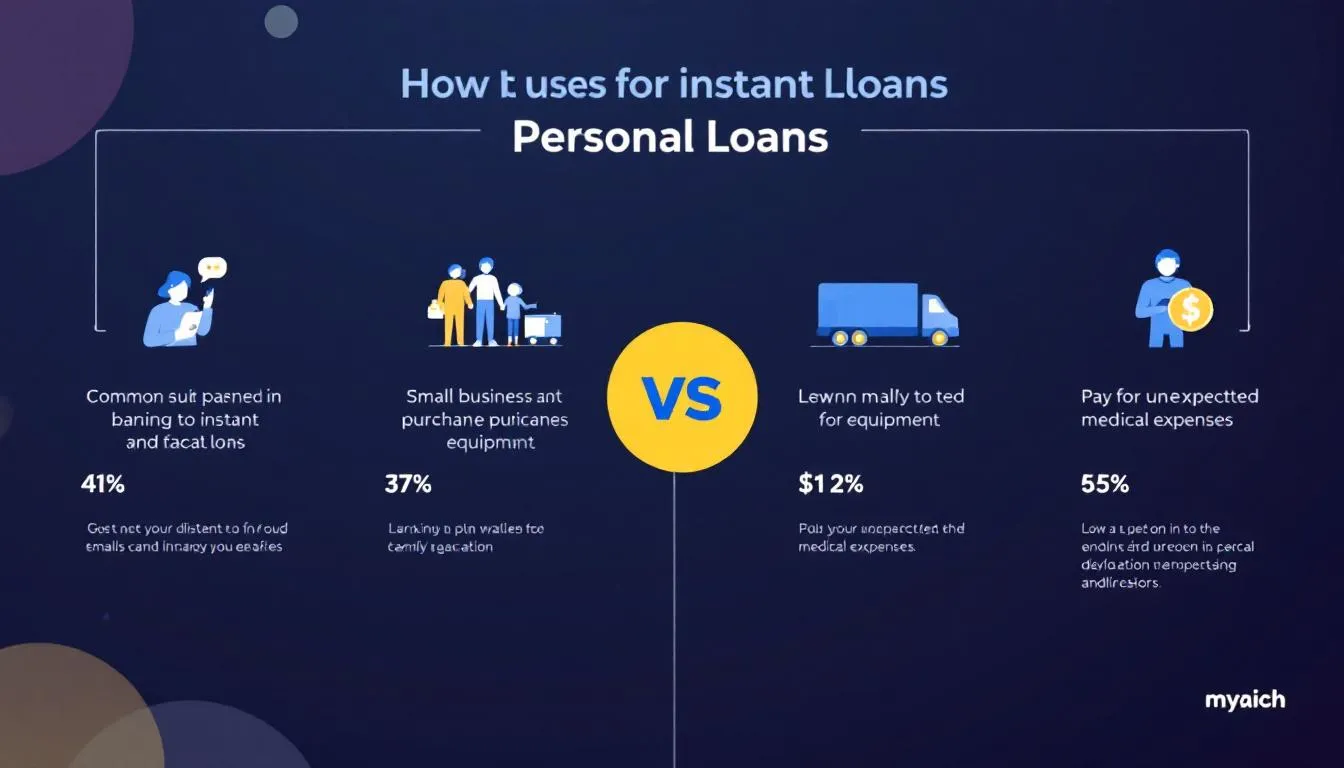

Common Uses for Instant Personal Loans

One of the greatest advantages of instant personal loans is the freedom to use the funds as you see fit. Whether it’s for financing a celebration, fixing a car, or covering educational expenses, there are no restrictions on how you can use the loan amount.

Debt consolidation is another prevalent reason for taking out personal loans. By consolidating multiple existing debts into a single payment, you can manage your finances more efficiently.

Personal loans are also commonly used for medical expenses, ensuring you have access to funds when you need your personal loan amount most, especially in a medical emergency.

How to Transfer Your Existing Loan to a New Lender

Transferring your existing loan to a new lender can be a strategic move to secure better interest rates or improve repayment terms through a personal loan balance transfer. If you have an existing personal loan, you may also consider transferring it to a new bank for better terms or topping up your existing personal loan to access additional funds. Begin by applying online to the new lender. Once approved, a pay order will be issued to settle the existing loan. This can help you save on interest costs and potentially reduce your monthly payments.

Under specific programs like the Golden Edge, meeting certain income requirements and paying 12 EMIs can waive foreclosure charges. Understanding these terms can be beneficial in making an informed decision about transferring your loan.

Summary

In summary, instant personal loans without documents offer a convenient and quick solution for various financial needs. Understanding the types of loans available, eligibility criteria, and the application process can empower you to make informed decisions. Whether you need funds for an emergency, education, or debt consolidation, these loans provide a hassle-free way to access the money you need swiftly. Take the time to review your options and choose the loan that best fits your financial situation and goals.

Frequently Asked Questions

What is an instant personal loan without documents?

An instant personal loan without documents is an unsecured loan that grants quick access to funds without requiring extensive paperwork. This convenience allows for faster financial support when needed.

How quickly can I get the funds from an instant personal loan?

You can receive funds from an instant personal loan within 30 minutes to 4 hours after loan approval. This rapid disbursement allows for quick access to needed funds.

What credit score do I need to qualify for an instant personal loan without documents?

To qualify for an instant personal loan without documents, you generally need a minimum CIBIL score of 685. A higher score may improve your chances of approval.

Can self-employed individuals apply for these loans?

Yes, self-employed individuals can apply for personal loans without a salary slip, as long as they meet the other eligibility criteria.

What are common uses for instant personal loans?

Instant personal loans are commonly used for financing celebrations, addressing medical emergencies, repairing vehicles, pursuing higher education, and consolidating debt. They offer flexibility for various financial needs.