Need to apply for a home loan? This guide simplifies the process for home loan applications. A bank home loan offers convenience, attractive interest rates, and flexible repayment options for homebuyers. Understand the steps, benefits, and key requirements to make your application as smooth as possible.

Key Takeaways

- Applying for a home loan online simplifies the process, offering convenience with digital document submission and real-time application tracking.

- Understanding the types of home loans available, including purchase, construction, and improvement loans, can help borrowers choose the best option for their needs.

- Bank home loans offer competitive interest rates, flexible loan amounts, and convenient application processes, making them an attractive choice for homebuyers.

- Home loans provide significant tax benefits, allowing deductions on principal and interest payments under various sections of the Income Tax Act.

Your Path to Home Ownership: Comprehensive Guide

Embarking on the journey to home ownership is both exciting and challenging. Understanding the home loan process and its benefits is the first step. A home loan, also known as a housing loan or house loan, is a financial product designed to help individuals purchase their dream homes. Applying online has made the process more streamlined and accessible, easing the path to home ownership.

Home loans offer significant advantages such as:

- Attractive interest rates

- Flexible repayment options

- Maximum loan amount of up to ₹5 Crore

- Home loan tenure extending up to 32 years, ensuring affordable EMIs and better financial management, with a favorable loan tenor

- Loan terms tailored to meet the specific needs of both salaried and self-employed individuals

- Flexible tenures typically ranging from 10 to 30 years, allowing borrowers to choose a repayment period that suits their financial plans.

Many lenders now offer higher loan eligibility, allowing borrowers to access larger loan amounts and making home ownership more affordable.

Applying for a home loan online offers a smooth experience and saves time. You can complete the application from home, submit documents digitally, and track the status in real-time. This convenience makes owning a home more attainable for many.

Home loans also come with home loan insurance, providing coverage in unforeseen circumstances. This ensures your family remains financially secure if you are unable to continue home loan repayment due to unexpected events.

Affordable EMIs and attractive interest rates make housing loans an ideal solution to avail home loan for turning your dream home into a reality.

Step-by-Step Process to Apply for a Home Loan Online

Applying for a home loan online is straightforward and can be done in a few steps. Here’s a guide to help you navigate the process.

First, select a reputable bank, such as Kotak Mahindra Bank, and fill out the application with accurate details. This step is known as the housing loan application process, where providing accurate information and complete documentation is crucial for successful approval. Ensure all information is correct to avoid delays. After submitting the application, pay the processing fee and submit the necessary documents.

After submitting your application, a bank representative will contact you to guide you through the next steps. This may include verifying your details through a home or workplace visit. The bank will ensure all information is accurate and complete before approving the loan. The loan is disbursed on positive verification of the application.

After verifications, you will sign the loan agreement, which outlines terms and conditions, including interest rates, loan amount, loan term, and repayment schedule. Carefully read and understand the terms before signing.

Finally, after signing the agreement, the loan disbursement of the sanctioned loan amount will be disbursed to your account, marking the completion of the process. The entire procedure is designed to be efficient and user-friendly, ensuring a smooth experience.

Types of Home Loans Available

Understanding the different types of home loans can help you choose the one that best suits your needs. Here are some of the most common options.

Home purchase loans are the most common, designed for buying new or pre-owned homes. They typically cover up to 85% of the property’s cost, easing the burden of paying the entire amount upfront through a secured loan.

Planning to build your own home? A construction loan might be the right choice. These loans finance new house construction, providing funds at different stages of the building process.

Home improvement loans are for renovation projects, allowing you to upgrade your existing home with new facilities or a fresh coat of paint.

For non-resident Indians (NRIs) looking to invest in property in India, NRI home loans cater specifically to their needs, offering attractive interest rates and flexible repayment options.

If you’re selling your current home and need funds to purchase a new one, a bridge loan can provide the short-term financing you need until your existing home is sold.

Home Loan Interest Rates Explained

Home loan interest rates are crucial in determining the overall cost of your loan, including various interest components. Understanding these rates can help you make informed decisions and potentially save money in the long run.

There are two primary types of interest rates: fixed and floating rate. Fixed rates remain constant, providing stability in your monthly EMIs. Floating rates can fluctuate based on market conditions, like changes in the Reserve Bank of India’s repo rate, offering lower initial rates but the risk of increasing over time. The rate of interest can significantly impact your financial decisions.

Interest rates can vary based on your credit score. A higher score indicates good creditworthiness, helping you secure more competitive rates. Additionally, a higher down payment can reduce the loan amount, leading to lower interest costs over the tenure.

Axis Bank, for example, offers competitive interest rates on home loan interest rates starting at an attractive interest rate of 8.75% per annum. Such home loan interest rate can significantly impact your overall loan cost, so it’s important to compare rates from different lenders before deciding.

Home Loan EMI Calculator

A home loan EMI calculator is an essential tool for planning your finances effectively by providing a clear picture of your monthly payments. Home loan calculators are valuable tools for estimating loan amounts, monthly EMIs, and eligibility, helping users plan their home purchase within their financial limits. It considers the principal amount, interest rate, and loan tenure to determine your monthly payments. By inputting different amounts and rates, you can see how changes impact your EMI, helping you choose the best loan terms for your budget.

Axis Bank’s EMI calculator offers the following features:

- User-friendly interface designed for convenience.

- Allows you to input various parameters and instantly see the results, making financial planning easier.

- Provides an annual amortization schedule, detailing yearly repayment of principal and interest.

- Helps you understand loan progression and total interest paid over the tenure.

For example, equated monthly installments for a home loan can start as low as ₹722 per lakh, depending on the amount and terms. Using the EMI calculator helps you see the total interest payable, aiding in better financial planning and ensuring you can comfortably manage monthly payments.

Eligibility Criteria for Home Loans

Meeting the eligibility criteria is essential for securing a home loan. Here are some key factors lenders consider when evaluating your application.

Individuals in permanent employment with government or reputable companies are eligible for a maximum home loan. Professionals like doctors and engineers, as well as self-employed individuals, can also apply. In major cities, the minimum monthly income for eligibility is ₹20,000, with an annual requirement of ₹2,40,000.

A good credit score is crucial for loan approval as it reflects your creditworthiness and credit history. Factors that can positively influence your eligibility include:

- Maintaining a low debt-to-income ratio

- Clearing existing loans before applying

- Making a larger down payment, which reduces the required loan amount and improves your chances of approval.

The minimum age to apply for a home loan is 21 years, with a maximum age at loan maturity up to 60 years for salaried applicants and 65 years for self-employed individuals. Lenders also conduct a technical assessment of the property to evaluate its compliance and quality, ensuring it meets all required standards.

Essential Documents Required for Home Loan Application

Accurate documentation, including property documents, is essential for securing a home loan. Here are the necessary documents for the application process.

Verification of identity can be done through documents like a passport, PAN card, or voter ID. Along with identity proof, KYC documentation must be submitted. Proof of income, such as salary certificates and income tax returns, is necessary for both salaried and self-employed individuals.

Self-employed applicants must also provide proof of business address and tax payment challans. Additionally, property details papers must be submitted to the bank as collateral, including documents like the sale agreement, tax receipts, and a certificate of possession.

Provide a loan application form along with three passport-sized photographs. Accurate and complete documentation ensures a smooth loan approval process and avoids delays.

Understanding Home Loan Charges and Fees

When applying for a home loan, understanding the associated charges and fees is crucial. Here’s a breakdown of the most common fees.

The processing fees are one of the initial costs when applying for a home loan, typically 1% of the loan amount with a minimum fee of ₹7,500. For loans exceeding ₹5 crore, the home loan processing fee can be ₹10,000. This non-refundable loan processing fee must be paid to initiate the application process. For salaried and self-employed professionals, processing fees can be up to ₹3,300 plus applicable taxes and statutory charges.

Additional charges may include stamp duty and regulatory fees like CERSAI fees and applicable taxes. If you wish to prepay your loan partially, charges may apply based on the remaining principal. Check with your lender about any prepayment penalties.

For floating interest rate term loans, floating rate loans:

- There is no foreclosure fee for individuals.

- If the prepayment exceeds 25% of the principal, a penalty of 2.5% plus taxes may apply.

- Some lenders may charge a fee for switching from a fixed rate to a variable one, up to 1.50% of the principal outstanding plus taxes.

- Some lenders do not charge prepayment fees for floating interest rate home loans when paying off the loan early.

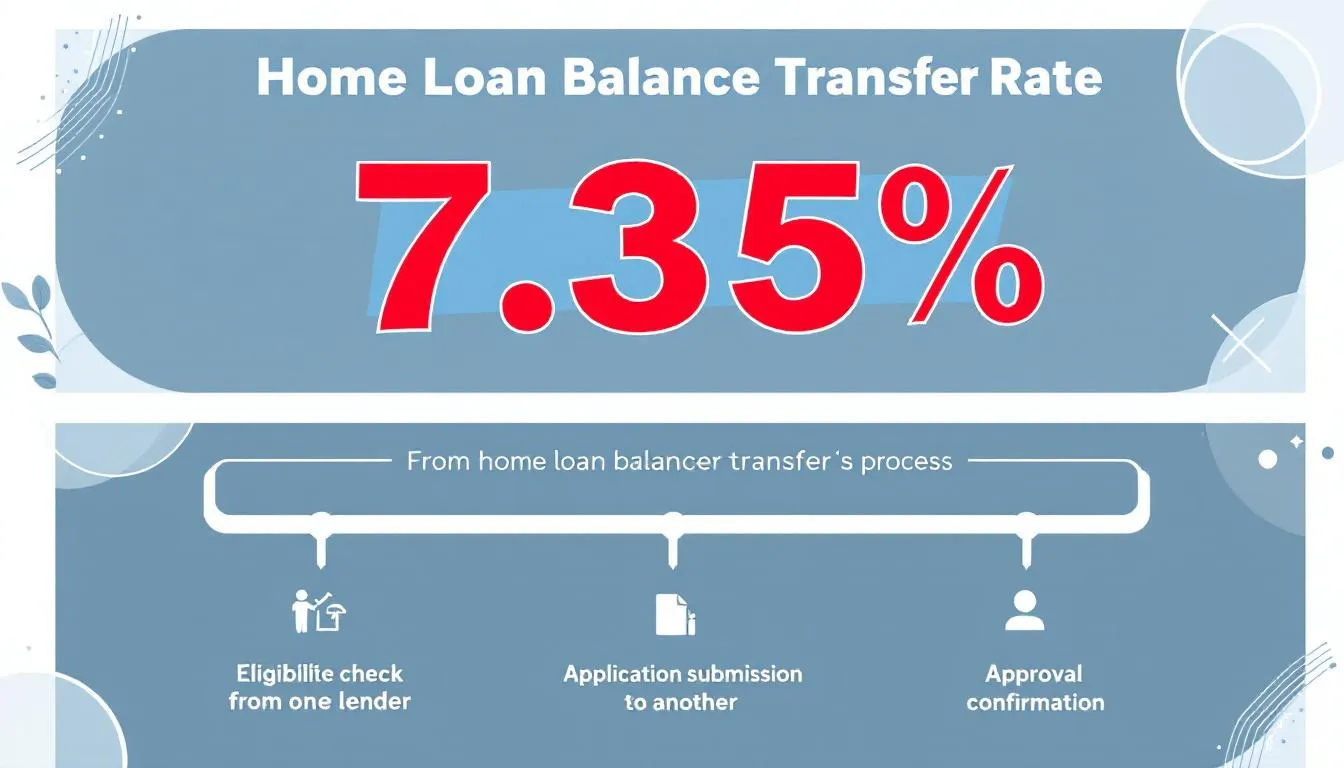

Benefits of Home Loan Balance Transfer

A home loan balance transfer allows you to move your existing loan to another bank to secure better interest rates. Here are some benefits of opting for a balance transfer loans.

By transferring your home loan to another bank, you can:

- Take advantage of lower interest rates, which can significantly reduce your overall loan burden.

- Benefit from lower monthly installments, making it easier to manage your finances.

- Access the option for a top-up loan of up to ₹1 crore for additional financing needs.

Customers who have transferred their existing home loans to another bank have reported exciting benefits for existing customer, including better interest rates and access to larger loan amounts. This can help you save money in the long run and reduce the financial strain of your home loan repayments.

Top-Up Loans for Additional Financing

Top-up loans provide an excellent option for securing additional financing for existing home loan customers. Here’s how they work and their benefits.

Existing home loan customers can request a top-up loan of up to ₹50 Lakhs secured against their property. These loans can be utilized for various purposes, such as:

- Construction

- Personal needs

- Business expenses Top-up loans typically have lower interest rates compared to personal loans, making them a cost-effective option for additional financing. Some lenders, like Bajaj Finance, offer top-up loans of up to ₹1 crore or more against existing home loans.

- Construction

- Personal needs

- Business expenses Top-up loans typically have lower interest rates compared to personal loans, making them a cost-effective option for additional financing.

It is important to note that funds from a top-up loan cannot be used for purchasing additional properties. The repayment of the top-up loan is done alongside the original home loan within the same tenure, ensuring that you do not have to manage multiple loan repayments separately.

Tax Benefits on Home Loans

Home loans come with significant tax benefits that can lead to substantial savings. Here are some of the key tax benefits available under various sections of the Income Tax Act.

Home loan tax deductions include:

- Principal repayments qualify for a tax deduction under Section 80C, limited to ₹1.5 lakh per year.

- Interest payments on home loans have a tax deduction limit of up to ₹2 lakh per annum.

- For rented properties, homeowners can deduct the entire interest paid on the home loan without any cap.

Deductions for home loan interest include:

- During the pre-construction phase, deductions can be claimed and spread over five years post-completion.

- Under Section 80EE, homebuyers can receive additional interest deductions of up to ₹50,000 for specific loans.

- Section 80EEA allows first-time buyers to claim interest deductions up to ₹1.5 lakh, provided the property’s stamp value does not exceed ₹45 lakh.

Joint home loan borrowers can each claim deductions for interest and principal repayment proportionate to their ownership. However, if the property is sold within five years, previously claimed principal repayment deductions must be added back to the taxpayer’s income, including the principal and interest components.

Loan Repayment and Management

Effectively managing your home loan repayment is key to making your dream home a reality while maintaining financial stability. Understanding the structure of your home loan, from the principal and interest components to the loan tenure and repayment options, can help you save on interest and pay off your loan comfortably.

- Home Loan EMI: Your home loan EMI (Equated Monthly Installment) is a fixed monthly payment that covers both the principal and interest components of your loan amount. Calculating your EMI in advance using a home loan EMI calculator helps you plan your finances and choose a loan tenure that fits your budget.

- Loan Tenure: The loan tenure, or loan term, is the period over which you agree to repay your home loan. While a longer loan tenure can lower your EMI, it may increase the total interest paid over the life of the loan. Choosing the right balance between EMI and loan tenure is crucial for effective loan management.

- Interest Rate: The interest rate on your home loan—whether fixed or floating—directly impacts your EMI and the total cost of your loan. Securing a competitive interest rate can significantly reduce your repayment burden. Always review the applicable interest rate and understand how it affects your monthly payments.

- Processing Fee: Lenders charge a one-time processing fee for handling your loan application. This fee, typically ranging from 0.5% to 1% of the loan amount, is non-refundable and should be factored into your overall loan costs.

- Home Loan Insurance: Opting for home loan insurance provides peace of mind by covering your outstanding housing loan amount in case of unforeseen events such as death or disability. This ensures your family’s financial security and protects your property investment.

- Loan Repayment Options: Repaying your home loan is convenient with multiple options like online payments, auto-debit instructions, or post-dated cheques. Setting up a standing instruction ensures timely EMI payments and helps maintain a good credit history.

- Eligibility Criteria: Your home loan eligibility is determined by factors such as income, employment status, credit score, and property value. Use a home loan eligibility calculator to assess your loan eligibility before submitting your loan application.

- Tax Benefits: Home loans offer attractive tax benefits under the Income Tax Act. You can claim deductions on principal repayment under Section 80C and on interest payments under Section 24(b) when filing your income tax returns, reducing your overall tax liability.

- Loan Disbursement: Once your loan is sanctioned, the loan disbursement process releases the approved loan amount, usually within a few days. Timely disbursement ensures you can proceed with your property purchase or construction without delays.

- Home Loan Top-Up: If you need additional funds, a home loan top up allows you to borrow over and above your existing home loan. This facility can be used for home renovation, expansion, or other personal needs, often at attractive interest rates and with minimal documentation.

By understanding these aspects of home loan repayment and management, you can make informed decisions, maximize your tax benefits, and ensure a smooth loan experience. Always review your loan agreement carefully, use online tools like the home loan EMI calculator, and seek professional advice if needed to manage your home loan efficiently and achieve your dream of home ownership.

Tips for a Successful Home Loan Approval

Securing a home loan approval can be a seamless process if you follow a few key tips:

- Maintain a good credit score.

- Understand that a high CIBIL score reflects your creditworthiness and can significantly enhance your home loan eligibility.

- Regularly check your credit report.

- Ensure all your debts are paid on time to help improve your credit score over time.

Another effective strategy is to have a co-applicant. Including co applicants, such as a spouse or family member, can combine credit profiles and increase the overall loan eligibility. This can be particularly beneficial if your co-applicant has a strong financial background, further boosting your chances of loan approval.

Preparing all necessary documents in advance and ensuring they are accurate and complete can also expedite the approval process.

Customer Testimonials

Hearing from existing customers can provide valuable insights into the home loan process. Many borrowers have praised Axis Bank for:

- Its straightforward and efficient online application process

- The ease of submitting documents digitally

- The ability to track the application status in real-time These features have been a significant advantage for many applicants.

Customers have also highlighted the quick response time from Axis Bank representatives after submitting their online loan applications. Clear communication and guidance throughout the loan process have left many borrowers feeling well-informed and supported. These positive experiences reflect the bank’s commitment to providing excellent customer service and making the home loan process as smooth as possible.

Summary

In summary, applying for a home loan online has never been easier. With competitive home loan interest rates, flexible repayment options, and a straightforward application process, securing a home loan is within your reach. Understanding the different types of home loans, using tools like the EMI calculator, and meeting the eligibility criteria can significantly improve your chances of loan approval.

Taking advantage of tax benefits, considering a home loan balance transfer, and exploring top-up loans for additional financing can further enhance your home loan experience. With the right preparation and understanding, you can confidently take the next step towards owning your dream home. Remember, the journey to home ownership is a significant milestone, and with the right support, it can be a smooth and rewarding experience.

Frequently Asked Questions

What is the maximum home loan amount I can apply for online?

You can apply for a home loan of up to ₹5 Crore online. Ensure you check with your lender for any specific eligibility criteria or conditions that may apply.

How can I improve my home loan eligibility?

To improve your home loan eligibility, focus on boosting your credit score, keeping a low debt-to-income ratio, and considering the option of a co-applicant. These steps can significantly increase your chances of approval.

What are the tax benefits associated with home loans?

Home loans offer significant tax benefits, as principal repayments are deductible under Section 80C, while interest payments can be deducted up to ₹2 lakh annually. Additional deductions are also available under Sections 80EE and 80EEA for certain loans.

What is a home loan balance transfer?

A home loan balance transfer enables you to shift your current home loan to a different bank for potentially lower interest rates, ultimately helping to decrease your total loan costs.

What documents are required for a home loan application?

You will need identity proof, KYC documentation, proof of income, property papers, and a completed loan application form along with passport-sized photographs to apply for a home loan. Being prepared with these documents can streamline your application process.