Are you looking for the best home loan interest rates? This guide walks you through comparing offers, understanding interest rates, and discovering factors that influence your home loan rate, such as credit score, loan amount, type of interest rate, employment stability, and market conditions.

Introduction to Home Loans

Home loans enable individuals to purchase a home by borrowing money from a lender. The interest rate on a home loan is a crucial factor that affects the total cost of the loan. Home loan interest rates can be either fixed or variable. Fixed interest rates offer stability and predictability in monthly payments, while variable interest rates can fluctuate based on market conditions. Understanding the various types of home loans, including fixed-rate and variable-rate loans, can help individuals make informed decisions when applying for a home loan.

Fixed interest rates offer the advantage of consistent monthly payments, making it easier to budget and plan for the future. This stability can be particularly beneficial in a fluctuating market. On the other hand, floating-rate loans are tied to market conditions and can vary over time. Floating-rate home loans can initially have a fixed interest rate that later transitions to a floating rate, offering flexibility and potential benefits such as no prepayment charges. While they may start with a lower interest rate, they carry the risk of increasing payments if market interest rates rise. Therefore, choosing between fixed and floating interest rates depends on your financial situation and risk tolerance.

Key Takeaways

- Home loan interest rates significantly impact monthly payments and overall loan costs, with fixed and floating rates presenting different advantages and risks.

- Factors such as credit score, income stability, loan amount, and tenure greatly influence the interest rates offered by lenders, necessitating strategic preparation for borrowers.

- Thoroughly comparing various home loan offers, considering all associated fees, and understanding contractual terms are essential steps for securing the best mortgage terms.

Understanding Home Loan Interest Rates

Home loan interest rates are the cornerstone of your mortgage, determining not only your monthly payments but also the total cost of your loan. Even a slight difference in interest rates can significantly impact the amount you pay over the life of the loan. Knowing the different types of interest rates and understanding the rate of interest fluctuations helps in making informed decisions.

Home loans offer either fixed or floating interest rates, each with distinct pros and cons. Fixed interest rates stay constant throughout the loan tenure, offering predictable repayments. In contrast, floating rates fluctuate with market conditions, impacting your monthly payments.

Fixed Interest Rates

Fixed interest rates offer stability and predictability, as they remain unchanged for the entire loan period. This means your EMIs will be consistent, making it easier to budget and plan your finances. Fixed rates are particularly beneficial when market interest rates are low and expected to rise in the future.

However, this stability often comes at a cost. Lenders typically charge higher rates for fixed interest rate home loans to offset the risk of potential market fluctuations. Despite this, the peace of mind that comes with knowing your payments won’t change can be invaluable for many borrowers.

Floating Interest Rates

Floating interest rates, on the other hand, are tied to a reference rate or index, such as the RBI’s repo rate, and can change over time. This means your monthly payments may vary, which can be advantageous if market interest rates decrease. Floating rate home loans can initially have a fixed interest rate that later transitions to a floating rate, offering flexibility and potential benefits such as no prepayment charges. A floating interest rate is influenced by overall economic conditions and can rise during periods of economic growth and fall during downturns, often compared to the benchmark rate.

While a floating rate loan can offer lower initial rates compared to fixed rate loans, it comes with the risk of increasing payments if market interest rates rise. Borrowers must be comfortable with this uncertainty and have the financial flexibility to accommodate potential changes in their EMIs, especially with floating rate loans.

Home Loan Interest Rate Options

When it comes to home loan interest rates, borrowers have several options to choose from, each with its own set of advantages and considerations. The two primary types of interest rates are fixed and floating, and understanding the differences between them can help you make an informed decision.

Factors Influencing Home Loan Interest Rates

Several factors influence the home loan interest rate you’ll be offered. Economic factors such as inflation and market trends also play a significant role, as they can cause interest rates to fluctuate based on the broader economic landscape. Lenders consider various aspects of your financial profile and property characteristics to determine the most suitable rate for you.

Understanding these main factors can help you optimize your loan application and secure more favorable terms.

Credit Score

Your credit score is a critical determinant of the interest rate you’ll receive. A high credit score indicates good creditworthiness, making you a lower risk for lenders and thus eligible for lower interest rates. Timely payments on all debts and keeping your credit utilization low are effective ways to maintain a good credit score.

Before applying for a home loan, it’s crucial to review and improve your credit score. Reducing existing debts, refraining from new credit applications, and regularly reviewing your credit report for inaccuracies can improve your score. This preparatory step can significantly impact the interest rate you’re offered.

Income Stability

Lenders prefer borrowers with a stable income, as it indicates a higher likelihood of timely loan repayment. Demonstrating a steady job history and avoiding significant debt can enhance your chances of securing favorable home loan interest rates.

Self-employed individuals may need to provide additional documentation for providing stability and further details to prove their income stability.

Loan Amount and Tenure

The loan amount and home loan tenure also play crucial roles in determining your home loan interest rate. Loans up to Rs 30 lakh typically come with lower interest rates. Additionally, making a larger down payment can help secure a lower interest rate by reducing the loan to value ratio and influencing the maximum loan amount based on permissible deduction norms and the maximum permissible loan-to-value (LTV) ratio.

Longer loan tenures typically come with higher interest rates. In contrast, shorter loan tenures usually offer lower rates. While longer terms may lower your monthly EMI, they increase the total interest paid over the entire loan tenure. Balancing your monthly payment capacity with the overall loan cost is key when selecting your loan tenure.

Factors Affecting Home Loan Eligibility

Several factors can affect home loan eligibility, including credit score, loan amount, loan tenure, and repayment capacity. A good credit score can help individuals secure a lower home loan interest rate, while a higher loan amount may result in a higher interest rate. The loan tenure, or repayment period, can also impact the interest rate, with longer tenures often resulting in higher interest rates. Additionally, the lender’s policies and market trends can also influence home loan eligibility. It’s essential to consider these factors when applying for a home loan to ensure the best possible interest rate.

Lenders assess your credit score to gauge your creditworthiness. A higher credit score indicates a lower risk, making you eligible for more competitive rates. The loan amount you seek also plays a role; larger loans may come with higher interest rates due to the increased risk to the lender. Similarly, the loan tenure affects the interest rate, with longer tenures typically attracting higher rates. Understanding these factors and preparing accordingly can enhance your chances of securing a favorable home loan interest rate.

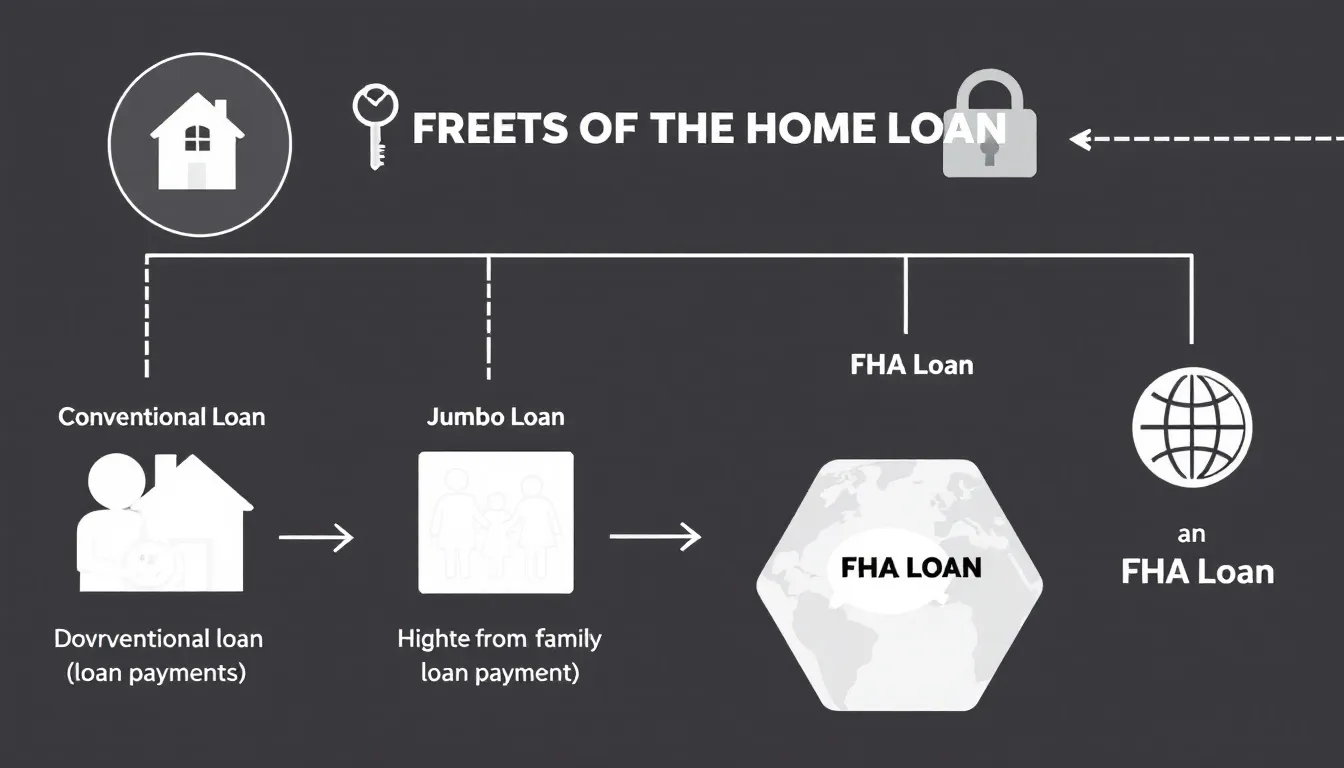

Types of Home Loans

Selecting the right type of home loan is crucial for meeting your financial needs and circumstances. Home loans are available in various forms, including standard loans for buying residential properties and specialized loans for specific needs.

Standard Home Loans

Standard home loans are financial products offered by banks and financial institutions for purchasing residential properties. They typically offer a straightforward repayment structure and are best suited for individuals looking to buy their primary residence. The housing loan interest rates for these products can change at the bank’s discretion.

Specialized Home Loans

Specialized home loans cater to specific needs, such as NRI home loans and plot loans. NRI home loans are designed for non-resident Indians and have specific eligibility criteria and documentation requirements. Plot loans, on the other hand, are for purchasing land with the intention of future home construction.

Banks like the Bank of Maharashtra offer various specialized home loans, including options for home renovations and bank offers tailored for NRIs. These specialized products can provide customized repayment options and attractive interest rates based on individual requirements.

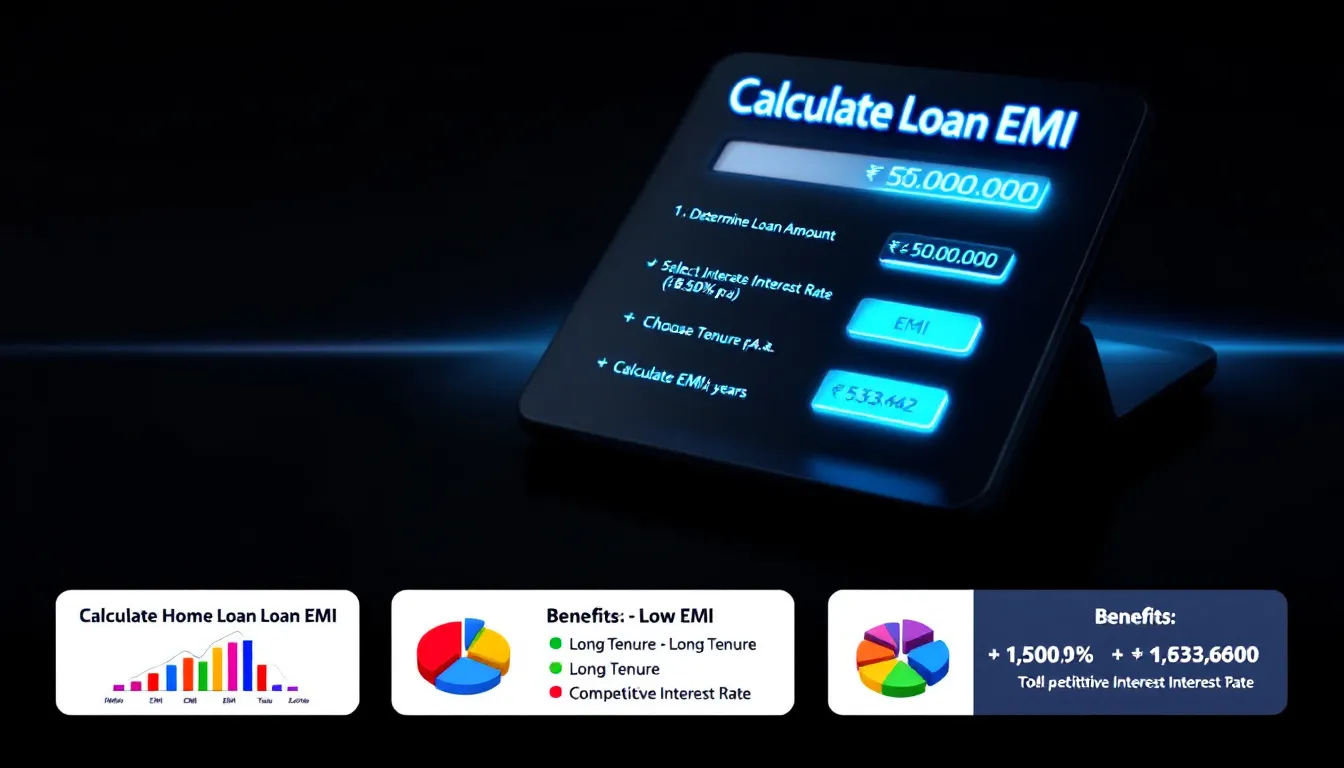

Calculating Your Home Loan EMI

Understanding how to calculate your home loan EMI is essential for financial planning. The maximum loan amount is calculated based on various factors including permissible deduction norms, lending-to-value (LTV) ratio, and the amount requested by the borrower. EMIs are calculated based on the loan amount, interest rate, and home loan emis. Knowing your EMI helps you budget effectively and ensures you can meet your monthly payment obligations.

Using an EMI Calculator

An online EMI calculator simplifies the process of estimating your monthly payments. By inputting your loan amount, interest rate, and tenure, you can quickly see your estimated EMI.

These calculators allow you to adjust parameters to understand how changes in loan amounts or interest rates affect your payments.

Manual Calculation Methods

For those who prefer manual calculations, the EMI formula is principal amount x R x (1+R)^N / [(1+R)^N-1], where principal amount is the principal amount, R is the monthly interest rate, and N is the number of payments.

This method requires converting the annual interest rate to a monthly rate and understanding the impact of compounding over time.

Repayment Period and Its Impact

The repayment period, or loan tenure, can significantly impact the total cost of a home loan. A more extended repayment period may result in lower monthly payments, but it can also increase the total interest paid over the life of the loan. On the other hand, a shorter repayment period can result in higher monthly payments, but it can also reduce the total interest paid. Understanding the impact of the repayment period on the total cost of the loan can help individuals make informed decisions when choosing a home loan. It’s also important to consider the loan to value ratio and the credit history when determining the repayment period.

Choosing the right repayment period involves balancing your monthly payment capacity with the overall cost of the loan. A longer tenure might make monthly payments more manageable, but it increases the total interest paid. Conversely, a shorter tenure means higher monthly payments but less interest over the loan’s life. Additionally, maintaining a good credit history and a favorable loan to value ratio can positively influence your loan terms, making it crucial to consider these factors when deciding on your repayment period.

Benefits of Lower Home Loan Interest Rates

Securing a lower home loan interest rate offers numerous benefits, from significant financial savings to better financial management. Fixed interest rates provide a safety net against market fluctuations, ensuring stability and predictability in your repayments.

Savings on Interest Costs

A lower interest rate greatly reduces the total cost of acquiring a home loan. Over the loan’s lifespan, even a slight reduction in the interest rate can lead to substantial savings.

This can free up resources for other financial goals and investments.

Better Financial Management

Lower monthly payments resulting from a lower interest rate enhance financial management by allowing more budget flexibility. This can lead to better financial stability, enabling you to save and invest more effectively.

How to Qualify for the Best Home Loan Rates

Qualifying for the best home loan interest rates requires strategic planning and financial discipline to achieve your dream home. Key steps include improving your credit score and choosing the right lender.

Improving Your Credit Score

A good credit score is vital for securing lower interest rates. Having a co-applicant can share financial responsibilities and help in obtaining higher loan amounts. Timely payments of loans and credit cards, keeping credit utilization low, and regularly checking your higher credit score and credit scores can help maintain a high credit history score.

Addressing any discrepancies in your credit report before applying for a loan can also improve your chances of getting a favorable rate.

Choosing the Right Lender

Selecting the right lender involves more than just comparing interest rates. Look for lenders that offer personalized service, transparency, and flexibility in loan terms.

Negotiating with lenders can also lead to better interest rates, especially if you have a strong financial profile.

Comparing Home Loan Offers

Thoroughly comparing home loan offers is essential to finding the best deal. Many applicants fail to do this, leading to potentially higher costs and less favorable terms.

What to Look For

When comparing loan offers, consider factors such as interest rates, loan tenure, prepayment options, and the lender’s customer service reputation.

Comparing offers from at least three different lenders can lead to a better deal and significant savings.

Tools and Resources

Online comparison tools can help you evaluate multiple home loan offers side by side, making it easier to find the best terms. Consulting financial advisors can also provide personalized insights into home loan options.

Utilizing both online tools and professional advice can enhance your decision-making process.

Applying for a Home Loan

Applying for a home loan can be a complex process, but it can be made easier by understanding the different types of home loans available and the factors that affect home loan eligibility. Individuals can apply for a home loan by visiting a lender’s website or branch, or by using a mortgage broker. It’s essential to provide accurate and complete information when applying for a home loan, including credit score, income, and employment history. The lender will then review the application and determine the home loan interest rate and terms based on the individual’s creditworthiness and other factors. The processing fee and other charges associated with the loan should also be considered.

When applying for a home loan, thorough preparation is key. Gather all necessary documents, such as proof of income, employment history, and credit score reports. Accurate and complete information can expedite the approval process and improve your chances of securing a favorable interest rate. Additionally, be aware of any processing fees and other charges that may apply, as these can affect the overall cost of your loan. Consulting with a mortgage broker can also provide valuable insights and help you navigate the application process more effectively.

Common Mistakes to Avoid When Applying for a Home Loan

Avoiding common mistakes during the home loan application process can save you time, money, and stress.

Overlooking Fees and Charges

Many borrowers focus solely on interest rates and overlook additional costs like processing fees and registration charges. These costs can significantly impact the total amount payable over the loan’s duration.

It’s crucial to account for all expenses when budgeting for your different budgets loan, as this can require a significant amount of planning.

Ignoring Fine Print

Failing to read the fine print in loan agreements can lead to unexpected charges and unfavorable terms. Thoroughly reviewing the terms and conditions helps avoid unexpected liabilities, such as penalties for early repayment.

Home Loan Customer Support

Home loan customer support is an essential aspect of the home loan process. Lenders should provide clear and concise information about the home loan interest rate, terms, and conditions, as well as any fees or charges associated with the loan. Individuals should also be able to easily contact the lender with questions or concerns about their home loan. Good customer support can help individuals navigate the home loan process and ensure that they are getting the best possible deal. The lender’s policies and market trends should also be considered when evaluating the customer support. Additionally, the lender should provide information on how to calculate the interest rate payments and the different methods used to calculate the interest rate.

Effective customer support can make a significant difference in your home loan experience. Look for lenders who offer transparent communication and are readily available to address your queries. Understanding the lender’s policies and staying informed about market trends can also help you make better decisions. Additionally, ensure that the lender provides clear instructions on calculating interest rate payments and explains the different methods used. This transparency and support can help you feel more confident and informed throughout the home loan process.

Home Loan Education and Resources

Understanding home loan interest rates and their implications is crucial for making informed decisions when applying for a home loan. Fortunately, there are numerous resources available to help borrowers navigate this complex landscape.

Summary

This section will summarize the key points discussed in the blog post, reinforcing the importance of understanding and comparing home loan interest rates. It will end with an inspiring message to encourage readers to take informed actions.

Conclusion

Home loan interest rates are a critical factor in determining the total cost of a home loan, and understanding the different types of interest rates and their implications is essential for borrowers. By comparing interest rates and terms offered by different lenders and considering individual financial goals and risk appetite, borrowers can make informed decisions and find the best home loan option.

A good credit score, stable income, and lower loan-to-value ratio can help borrowers negotiate better interest rates with lenders and reduce their interest costs. It’s also important to consider other factors, such as processing fees, repayment capacity, and customized repayment options, when choosing a home loan.

Ultimately, finding the right home loan with an attractive interest rate and suitable terms can help borrowers achieve their dream of owning a home while managing their financial obligations effectively. By taking the time to understand your options and prepare accordingly, you can secure a home loan that aligns with your financial goals and provides long-term benefits.

Frequently Asked Questions

What is the difference between fixed and floating interest rates?

The difference lies in stability; fixed interest rates remain constant for the duration of the loan, offering predictability, while floating interest rates vary with market conditions, resulting in potentially fluctuating payments. This distinction is crucial when considering the overall cost and budgeting for your loan.

How does my credit score affect my home loan interest rate?

Your credit score significantly impacts your home loan interest rate; a higher score can qualify you for lower rates due to perceived creditworthiness. Therefore, improving your score through timely payments and reducing debt can lead to more favorable loan terms.

What factors should I consider when comparing home loan offers?

It is essential to evaluate the interest rates, loan tenure, prepayment options, and the lender’s customer service reputation when comparing home loan offers. Utilizing online comparison tools and seeking advice from financial advisors can further enhance your decision-making process.

Are there any additional costs associated with home loans that I should be aware of?

Yes, home loans often come with additional costs such as processing fees, registration charges, legal fees, and insurance premiums, all of which can significantly influence the overall financial obligation over the loan period. It is important to verify the interest rates mentioned with the bank for accuracy, as these rates are subject to change. It is important to consider these expenses when budgeting for a home loan.

How can I improve my chances of qualifying for the best home loan rates?

To enhance your chances of qualifying for the best home loan rates, concentrate on boosting your credit score, ensuring stable income, and considering a larger down payment. Additionally, selecting a lender known for transparency and opting for a shorter loan term can further improve your rate options.